Sadly, the left can’t see the forest for the trees because the word “gun” is involved. Their narrow-minded thought process on this issue frightens them, even when it will save the lives of children

PM Anthony Albanese, Senator Jacqui Lambie, eSafety Commissioner Julie Inman Grant should be told that terrorism is real; that you cannot possibly unsee what you have already seen online

USA will also be making demands for them to correct the issues and follow the law. Should they refuse, USA has an answer and will follow by taking legal action against these and other invalid elections

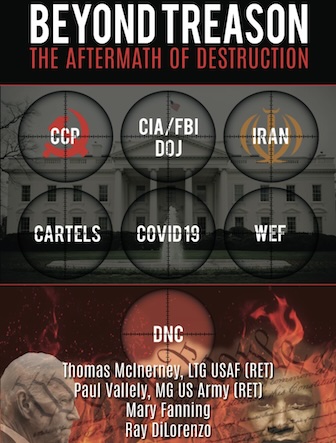

This country, and even the rest of the world, are at a crossroads. Do we want the Democratic path where we choose rulers and where the individual exists to serve the State, or do we want the Republican path with representative leaders and a State tha

Regardless of how slick or polished it is, a lie can never be seen as something we call intelligent

Every day, we are getting closer to the point of no return. We know that we're headed in the wrong direction, and if we stay on this path, we'll go full Weimar, carrying our cash not in wallets but in wheelbarrows.

The woke insanity of the left: They are not only attacking women but also the moral foundations of our society. Their arguments for equity and inclusion lack coherence and are based on meaningless delusions

Bringing Down The Hammer For Canada Free Press: It seems so easy to me: Christianity and hope, or atheism and nihilism; or, through a less existential lens: destruction and Islam. Isn’t it as simple as sanity or insanity?