By Matthew Vadum -- BombThrowers——Bio and Archives--November 6, 2017

American Politics, News | CFP Comments | Reader Friendly | Subscribe | Email Us

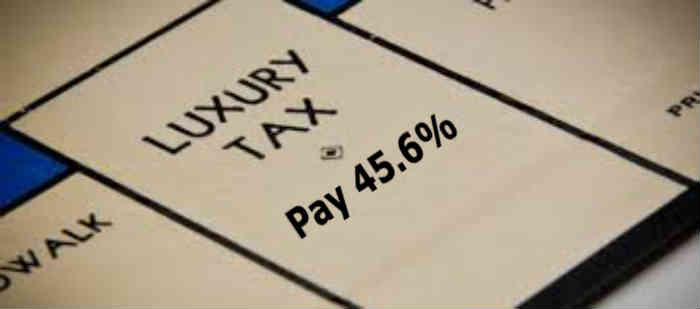

The GOP’s newly unveiled tax reform legislation would raise taxes on high earners to 45.6 percent, not cap them at 39.6 percent, as its proponents claim, according to an analysis of the proposal by Danny Vinik of Politico.

Republicans’ proposed “Tax Cuts and Jobs Act” would collapse the current seven individual income tax brackets – 10, 15, 25, 28, 33, 35, and 39.6 percent into just four – 12, 25, 35, and 39.6 percent – according to a summary of major details by the Tax Foundation.

The GOP’s newly unveiled tax reform legislation would raise taxes on high earners to 45.6 percent, not cap them at 39.6 percent, as its proponents claim, according to an analysis of the proposal by Danny Vinik of Politico.

Republicans’ proposed “Tax Cuts and Jobs Act” would collapse the current seven individual income tax brackets – 10, 15, 25, 28, 33, 35, and 39.6 percent into just four – 12, 25, 35, and 39.6 percent – according to a summary of major details by the Tax Foundation.“Thanks to a quirky proposed surcharge, Americans who earn more than $1 million in taxable income would trigger an extra 6 percent tax on the next $200,000 they earn—a complicated change that effectively creates a new, unannounced tax bracket of 45.6 percent.”Vinik continues:

Here’s how it would work: After the first $1 million in taxable income, the government would impose a 6 percent surcharge on every dollar earned, until it made up for the tax benefits that the rich receive from the low tax rate on that first $45,000. That surcharge remains until the government has clawed back the full $12,420, which would occur at about $1.2 million in taxable income. At that point, the surcharge disappears and the top tax rate drops back to 39.6 percent. This type of tax is sometimes called a “bubble tax,” because the marginal tax rate effectively bubbles up for a brief period before falling back to a lower level. According to POLITICO’s calculation, the surcharge could raise more than $50 billion over a decade—money that will help the GOP meet the $1.5 trillion in increased deficits that their budget allows for and required to balance out tax cuts elsewhere. Balancing out those costs means that the bill can pass through budget reconciliation, and Senate Democrats can’t filibuster the bill.A spokesperson for the chief tax-writing panel in Congress, the House Ways and Means Committee, offered creative spin. The bubble is “the phase-out of a tax benefit” for high earners, not a surcharge. “The Tax Cuts and Jobs Act provides tax relief at every income level.” We’ll see about that.

View Comments

Matthew Vadum, matthewvadum.blogspot.com, is an investigative reporter.

His new book Subversion Inc. can be bought at Amazon.com (US), Amazon.ca (Canada)

Visit the Subversion Inc. Facebook page. Follow me on Twitter.