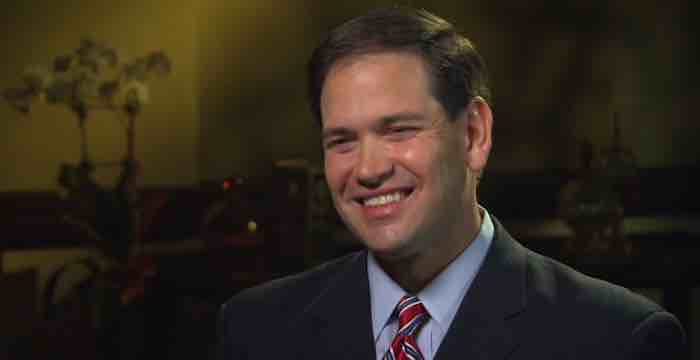

Yesterday, Dan told you about Marco Rubio's threat to submarine tax reform if he and Mike Lee didn't get an expansion in the way the child tax credit was applied.

As RedState put it:

Yesterday, Dan told you about Marco Rubio's threat to submarine tax reform if he and Mike Lee didn't get an expansion in the way the child tax credit was applied.

As RedState put it: Essentially, the Rubio-Lee plan would expand the child tax credit to allow millions of families to claim the credit who pay payroll taxes even if they don’t earn enough to pay income taxes. They planned to pay for this increased credit by slightly shrinking the tax bill’s proposed cut to the corporate tax rate. Currently, the corporate tax rate is 35 percent, and the bill cuts that to 20 percent. The Rubio-Lee plan would trim that slightly, cutting it to 21 percent. Senate leadership seems to be amenable to some expansion, but not as large a scale as Rubio wanted. The latest version of the bill increases the child tax credit to $2,000 per child, up from the current $1,000.Now, according to one report, Rubio has gotten his way - or, more specifically, part of his way. The expansion may not be as big as Rubio and Lee wanted, but there is an expansion. Over at the WSJ, they're indicating that the refundable portion of the child tax credit has indeed been increased, and at least one Representative is claiming that's enough to satisfy Rubio.

The refundable part of the child-care tax credit has been increased to $1,400 per child, Rep. Kristi Noem (R., S.D.) said Friday after signing the final tax conference report. Sen. Marco Rubio (R., Fla.) had balked at the bill Thursday, saying he wanted to see an increase from $1,100 in the previous version. Ms. Noem said Mr. Rubio had not personally told her he would now support the bill, but she thought the boost would be enough to get him on board. "I believe that we're in a good spot and we should be able to earn his support," Ms. Noem said.

Robert Laurie’s column is distributed by HermanCain.com, which can be found at HermanCain.com

Be sure to “like” Robert Laurie over on Facebook and follow him on Twitter. You’ll be glad you did.