By Dan Calabrese ——Bio and Archives--September 18, 2017

American Politics, News | CFP Comments | Reader Friendly | Subscribe | Email Us

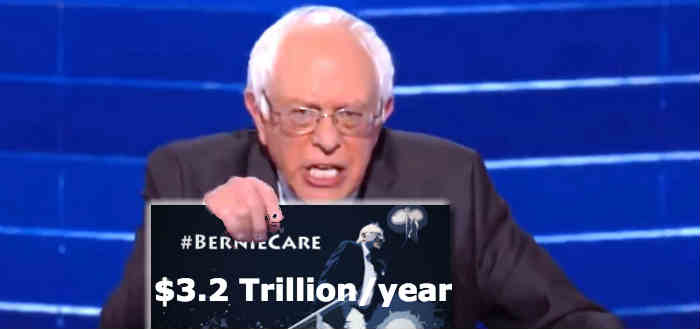

National health expenditures for acute care for the nonelderly would increase by $412.0 billion (22.9 percent) in 2017. Aggregate spending on acute care services for those otherwise enrolled in Medicare would increase by $38.5 billion (3.8 percent) in 2017. Long-term service and support expenditures would increase by $68.4 billion (28.6 percent) in 2017. Together, national health expenditures would increase by a total of $518.9 billion (16.9 percent) in 2017, and by 6.6 trillion (16.6 percent) between 2017 and 2026. The increase in federal expenditures would be considerably larger than the increase in nation health expenditures because substantial spending borne by states, employers, and households under current law would shift to the federal government under the Sanders plan. Federal expenditures in 2017 would increase by $1.9 trillion for acute care for the nonelderly, by $465.9 billion for those otherwise enrolled in Medicare, and by $212.1 billion for long-term services and supports.

In total, federal spending would increase by about $2.5 trillion (257.6 percent) in 2017. Federal expenditures would increase by about $32.0 trillion (232.7 percent) between 2017 and 2026. The increase in federal spending is so large because the federal government would absorb a substantial amount of current spending by state and local governments, employers, and households. In addition, federal spending would be needed for newly covered individuals, expanded benefits and the elimination of cost sharing for those insured under current law, and the new long-term support and services program.You might consider it a mitigating factor that much of this spending would be a shift from current spending by state and local governments, employers and households. Why, it's not new spending. It's just moved spending! No. That doesn't make it better. It makes it worse. You have to understand that the reason Democrats want socialized medicine is because their big-picture goal is to transfer control of as much of the nation's GDP as possible to the federal government. In 2016, the entire gross domestic product of the United States was about $18.6 trillion. With this proposal, roughly $7.1 trillion of that would be usurped by Washington. That's an absolutely astonishing number. Traditionally federal spending has been around 20 percent of GDP. In the first few years of the Obama Administration it rose to 24 percent, as it had last done during World War II, before reverting back to its norm. Under this proposal, federal spending would skyrocket to 38 percent of GDP!

Support Canada Free Press

View Comments

Dan Calabrese’s column is distributed by HermanCain.com, which can be found at HermanCain

Follow all of Dan’s work, including his series of Christian spiritual warfare novels, by liking his page on Facebook.