It’s been a disastrous year so far for pensions across the country as plans release their annual reports. These reports based on 2011 data don’t take into account the reality that equity markets have not risen dramatically since the beginning of the year, but rather have continued to lose value.

The shortfalls - in the hundreds of billions of dollars and growing every day - require urgent attention and drastic structural changes. Remedial actions are being hindered, however, by potential conflicts of interest, threats of legal action and multi-million advertising campaigns aimed at preserving the status quo.

So far no major public sector union has implemented meaningful changes, preferring to continue to draw additional contributions from taxpayers and to hope for stunning financial gains in the marketplace.

The Nova Scotia teachers plan recently revealed that the taxpayers of that province are on the hook for a pension shortfall of $1.655 billion. This is an increase from the 2010 shortfall of $1.114 billion the year before.

Share this $511 million cost across 13,525 active teachers and the annual shortfall works out to $37,781 per teacher. The cumulative shortfall now is $122,365 per working teacher.

The numbers tell the story. Employee/employer contributions were $132.7 million last year, but payouts were $348 million. Pension funds are designed to be self-supporting, but this plan, like so many others with generous guaranteed lifetime payments and low contribution rates, has become a ponzi plan, reliant on new money to pay those who didn’t contribute enough and are now collecting.

Even more worrying for the plan is that the 12,014 retirees are counting on only 13,525 active teachers to fund their retirement. Unless the taxpayer antes up a lot more to bail out the funds. Based on demographics this current $1.655 billion shortfall can be expected to increase for the entire next generation.

Where will this money come from, and are the pension payouts too high? Some experts are suggesting that the holy grail of pensions - defined (guaranteed) benefits indexed for life - must be discarded, and a new plan be built.

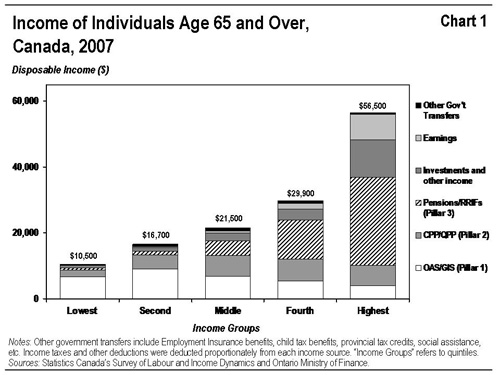

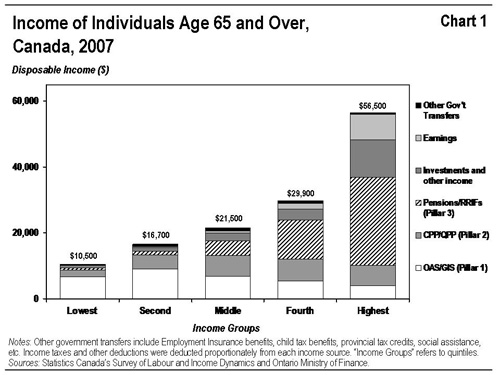

The average NS teacher retiring in 2011 received income from the plan of $29,016. Once we add in the Canada Pension Plan payment of $11,500 and Old Age Security of $6,000 a retired teacher made about $ 46,516 last year. Many make much higher than that because the average includes teachers who have worked much less than the full 35 years (as few as 5 years) and receive pensions based on that.

Compare this to the average Nova Scotia taxpayers who will reach age 65 with a pension with a total value of only $60,000 to supplement their CPP and OAS. By the time they reach 67 the average teacher - retiring at 59 - will have collected $232,000 in pension income.

See graph below

At Canada's biggest teachers pension in Ontario the average age of retirement is 59 and teachers are indeed working for 27 years, but they are now retiring for 32. Did you notice last month the federal government raised the age of retirement to 67 for the rest of us?

The Nova Scotia premier’s “solid action plan” is a commitment to "sit tight on these plans and allow for the natural cycle of the markets to complete its course.” Given recent history, this is a very dangerous route to take. Demographers insist the world has never experienced an age wave the size of the Baby Boom generation, so all bets are off that mature economies (i.e the Western world) will see continuous growth in the next 30 years, with so many people in non-productive retirement.

The market is down about 2% since the start of the year and down 14% over one year with a negative 15% five year return. Considering the plan is expected to do about 6.5% over five years it is short returns from the Canadian stock markets of 47%. It will take a miracle for the plan of the Nova Scotia Premier to work.

In fact, even if the stock market returned to peak 2007 levels it would not bring the NS pension plan back to it's $55 million shortfall position of that year, because the plan has lost four years of compounded investment growth that it had previously assumed.

It’s government by divine intervention and if that does not work taxpayers are on the hook for the pensions anyways. With a solution like this, taxpayers better run for the hills and younger teachers making contributions worth over $12,000 a year matched by taxpayers with an equal amount...will the plan be there when they need it?

Some interesting stats from Bill Black, a recognized pension expert, show that the largest group of MLA's in Nova Scotia., almost 30% is teachers by background. Most will be counting on their teacher’s pensions for some of their retirement income. Or will they bail out the plan with more tax dollars?

Most taxpayers are blissfully unaware that they made a major bailout to the Nova Scotia public service pension plan in 2010 of more than $500 million, netting active employees a tax free pension contribution of over $30,000 each. Did any government bailout your RRSP after it crashed in 2008?

Was this throwing good money after bad? What will be the story in a couple of months when the annual report is made on this plan? Expect another $500 million loss? Another $500 million “donation” from taxpayers? Pay attention taxpayers this problem is not going away.

The province and unions are making noise about changes that will solve the pension crisis. However, as we have seen around North America and in fact the world, unless real structural changes are made to pensions they will not survive. Hocus pocus accounting such as pension solvency relief, joint trusteeship and target date pensions have come far short of solving the problem anywhere. What is need is a conversion away from guaranteed defined benefit to the type of plan taxpayers have for themselves, defined contribution.

The head of Canada's largest teachers pension plan suggests pensions across the country review a plan called the hybrid pension. Also known as a stacked plan, it is half defined benefit and half defined contribution. The plan offers a guaranteed defined benefit plan base offering 1% of annual salary with a top-up of the same contribution amount into a defined contribution portion. A recent deal between Air Canada and its flight attendants recommended the same hybrid.

This compares to the 2% plans that most public sector employees are on today. Based on their final average salary employees get 2% for each year worked so that after 35 years the employees gets 70% if his final average pay. With a top teachers making $85,699 in Nova Scotia that is a nice deal.

As provinces struggle with a deficit there are only a few options to fund pensions. They can cut services, raise taxes or borrow more money on your credit. It appears that Nova Scotia has done all these things. We advocate for a more permanent solution, pension reform.

Everyone is counting on the government to do the right thing. Social service organizations counting on government support to fund their activities, taxpayers struggling under increasing tax burdens to fund their own retirements and new employees wondering if punishing pension contributions will provide a pension when they need it.

What will it be - a well balanced program of services that taxpayers expect for their hard earned money or gold-plated pensions for a few well protected public sector employees? Unfortunately we can't have both.

Bill Tufts——

Bio and Archives

Bill Tufts, Fair Pensions For All, founded in January 2009, our goal is to promote an honest and fair analysis of our pension system; to expose abuse and waste within the system; to develops and promote new ideas and concepts on pensions based on fairness for all.

We maintain that it is every Canadian’s right to receive sufficient income in retirement to afford an acceptable quality of life.

Everyone is counting on the government to do the right thing. Social service organizations counting on government support to fund their activities, taxpayers struggling under increasing tax burdens to fund their own retirements and new employees wondering if punishing pension contributions will provide a pension when they need it.

What will it be - a well balanced program of services that taxpayers expect for their hard earned money or gold-plated pensions for a few well protected public sector employees? Unfortunately we can't have both.

Everyone is counting on the government to do the right thing. Social service organizations counting on government support to fund their activities, taxpayers struggling under increasing tax burdens to fund their own retirements and new employees wondering if punishing pension contributions will provide a pension when they need it.

What will it be - a well balanced program of services that taxpayers expect for their hard earned money or gold-plated pensions for a few well protected public sector employees? Unfortunately we can't have both.