By Sierra Rayne ——Bio and Archives--July 11, 2014

Global Warming-Energy-Environment | CFP Comments | Reader Friendly | Subscribe | Email Us

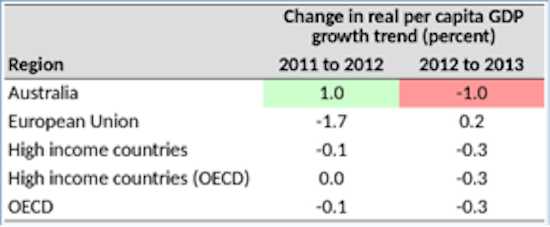

The Aussie slowdown from 2012 to 2013 can't be blamed on a weaker export market. The real per capita GDP growth rate in China -- by far Australia's largest trading partner -- was unchanged from 2012 to 2013. Australia's total exports actually declined from 2011 to 2012 (while the overall economy increased its rate of growth), and then increased from 2012 to 2013 (in contrast to the economy, which slowed down considerably), the complete reversal of the economic growth trends. The export increase from 2012 to 2013 also outperformed the prior 5-year average for export growth.

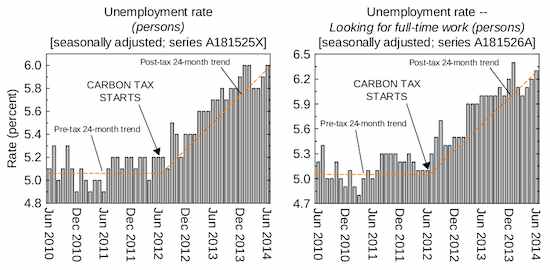

The only rational explanation based on the data anyone -- included both pro- and anti-carbon tax groups -- has presented to date is that the carbon tax severely harmed the Australian economy, essentially halting and reversing the accelerating growth trend built up over the pre-tax period.

As Abbott moves forward, he needs to be careful that his government doesn't shift from overt (and more economically efficient) carbon taxation to backdoor (and less efficient) carbon pricing -- a mistake Canada has already made. According to media reports, Abbott "promised to replace the tax with a AU$2.55 billion fund to help polluters convert to cleaner technologies." This AU$2.55 billion fund -- which covers the first four years, after which it will be increased to AU$1.2 billion per year -- to help polluters convert to cleaner technologies would presumably come from tax dollars, which the taxpayers would obviously need to pay for. This is an effective carbon tax.

Replacing one carbon tax with another isn't the answer, and will just cause more trouble than you started with. Some environmental groups are already finding problems with Abbott's economic math, and they may have a point. A market-based mechanism is inherently more efficient than a regulatory approach whose incentives are funneled through the government bureaucracy, making for a regulatory system ripe with crony capitalism and bad decisions.

Abbott has the economic high ground to justify a full repeal of the carbon tax, and to not replace it with any greenhouse gas reduction measures of any form. But if he follows the path he appears to be on (i.e., repeal-and-replace rather than just a full repeal), both economic and political trouble is probably in store for him.

The Australian Prime Minister could learn some lessons from the mistakes of his Canadian counterpart. Stephen Harper's government repeatedly attacked the left-wing opposition parties over their support for carbon pricing, but then Harper's administration brought in a host of economically punitive greenhouse gas reduction measures that equated to effective carbon taxation. The voters weren't fooled, realizing that if carbon pricing is inevitable, the preferred approach is a market mechanism (oddly enough, being proposed by the left-wing -- rather than right-wing -- parties) rather than regulatory fumbling. Sure enough, support for Harper's government has plummeted, undoubtedly because the public is thinking that if they wanted liberal environmental policies, they may as well vote for a liberal government.

It's the same reason why the GOP has lost the popular vote in five of the last six presidential elections (and only barely won in 2004). If you give the public a choice between a real liberal and a faux conservative, they will almost always choose the real liberal. If you give them a real conservative (say, like Reagan), the results speak for themselves. These realities appear to be setting in down under.

Abbott's government is steadily losing public support, and recent polls have Labor well in the lead and massive public dissatisfaction with Abbott. The voters elected Abbott to govern more like a principled conservative than a weak liberal, and his tendencies towards the latter are hurting his popularity. If Abbott shifts to the mushy middle on climate issues, Labor will just use his weakness to say that they were right all along on the need to reduce greenhouse gas emissions, and that their carbon tax was a better approach.

There will be calls from within Abbott's government to move left on environmental issues and build partnerships in the middle. Instead, Abbott needs to stay the tough course, remove any and all forms of direct and indirect carbon taxation, wait for the Australian economy to respond, and then reap the rewards in terms of renewed public support for holding the line (much as Reagan did in his first few years in office). Now is not the time for wobbly knees, and Abbott needs international allies. That is a note to you, Stephen Harper. Step up and help Abbott build a strong, unequivocal alliance against any forms of carbon taxation, and get rid of all the backdoor carbon taxation you foisted on Canada since 2006. It will improve our economic performance, and for that you will be rewarded at the polls.

The Aussie slowdown from 2012 to 2013 can't be blamed on a weaker export market. The real per capita GDP growth rate in China -- by far Australia's largest trading partner -- was unchanged from 2012 to 2013. Australia's total exports actually declined from 2011 to 2012 (while the overall economy increased its rate of growth), and then increased from 2012 to 2013 (in contrast to the economy, which slowed down considerably), the complete reversal of the economic growth trends. The export increase from 2012 to 2013 also outperformed the prior 5-year average for export growth.

The only rational explanation based on the data anyone -- included both pro- and anti-carbon tax groups -- has presented to date is that the carbon tax severely harmed the Australian economy, essentially halting and reversing the accelerating growth trend built up over the pre-tax period.

As Abbott moves forward, he needs to be careful that his government doesn't shift from overt (and more economically efficient) carbon taxation to backdoor (and less efficient) carbon pricing -- a mistake Canada has already made. According to media reports, Abbott "promised to replace the tax with a AU$2.55 billion fund to help polluters convert to cleaner technologies." This AU$2.55 billion fund -- which covers the first four years, after which it will be increased to AU$1.2 billion per year -- to help polluters convert to cleaner technologies would presumably come from tax dollars, which the taxpayers would obviously need to pay for. This is an effective carbon tax.

Replacing one carbon tax with another isn't the answer, and will just cause more trouble than you started with. Some environmental groups are already finding problems with Abbott's economic math, and they may have a point. A market-based mechanism is inherently more efficient than a regulatory approach whose incentives are funneled through the government bureaucracy, making for a regulatory system ripe with crony capitalism and bad decisions.

Abbott has the economic high ground to justify a full repeal of the carbon tax, and to not replace it with any greenhouse gas reduction measures of any form. But if he follows the path he appears to be on (i.e., repeal-and-replace rather than just a full repeal), both economic and political trouble is probably in store for him.

The Australian Prime Minister could learn some lessons from the mistakes of his Canadian counterpart. Stephen Harper's government repeatedly attacked the left-wing opposition parties over their support for carbon pricing, but then Harper's administration brought in a host of economically punitive greenhouse gas reduction measures that equated to effective carbon taxation. The voters weren't fooled, realizing that if carbon pricing is inevitable, the preferred approach is a market mechanism (oddly enough, being proposed by the left-wing -- rather than right-wing -- parties) rather than regulatory fumbling. Sure enough, support for Harper's government has plummeted, undoubtedly because the public is thinking that if they wanted liberal environmental policies, they may as well vote for a liberal government.

It's the same reason why the GOP has lost the popular vote in five of the last six presidential elections (and only barely won in 2004). If you give the public a choice between a real liberal and a faux conservative, they will almost always choose the real liberal. If you give them a real conservative (say, like Reagan), the results speak for themselves. These realities appear to be setting in down under.

Abbott's government is steadily losing public support, and recent polls have Labor well in the lead and massive public dissatisfaction with Abbott. The voters elected Abbott to govern more like a principled conservative than a weak liberal, and his tendencies towards the latter are hurting his popularity. If Abbott shifts to the mushy middle on climate issues, Labor will just use his weakness to say that they were right all along on the need to reduce greenhouse gas emissions, and that their carbon tax was a better approach.

There will be calls from within Abbott's government to move left on environmental issues and build partnerships in the middle. Instead, Abbott needs to stay the tough course, remove any and all forms of direct and indirect carbon taxation, wait for the Australian economy to respond, and then reap the rewards in terms of renewed public support for holding the line (much as Reagan did in his first few years in office). Now is not the time for wobbly knees, and Abbott needs international allies. That is a note to you, Stephen Harper. Step up and help Abbott build a strong, unequivocal alliance against any forms of carbon taxation, and get rid of all the backdoor carbon taxation you foisted on Canada since 2006. It will improve our economic performance, and for that you will be rewarded at the polls.View Comments

Sierra Rayne holds a Ph.D. in Chemistry and writes regularly on environment, energy, and national security topics. He can be found on Twitter at @srayne_ca