The Trump Redirect Comes Not a Moment Too Soon

Despite Electric Vehicles, World Petroleum Consumption Will Continue to Climb

The Energy Information Administration’s (EIA)

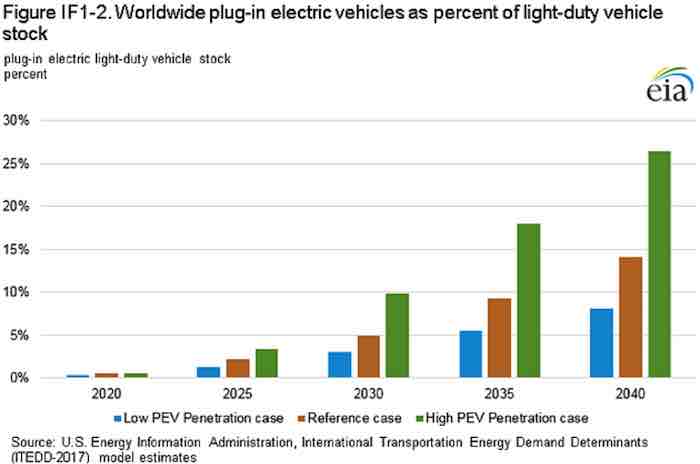

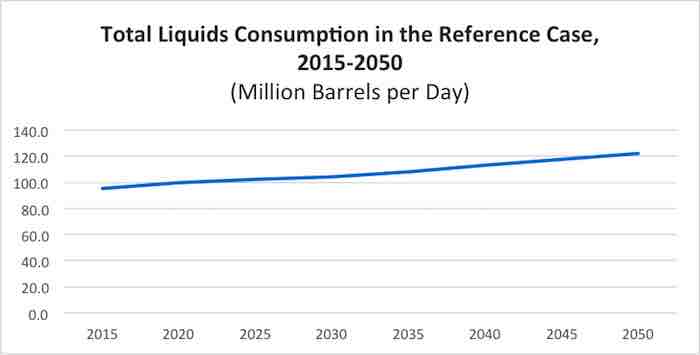

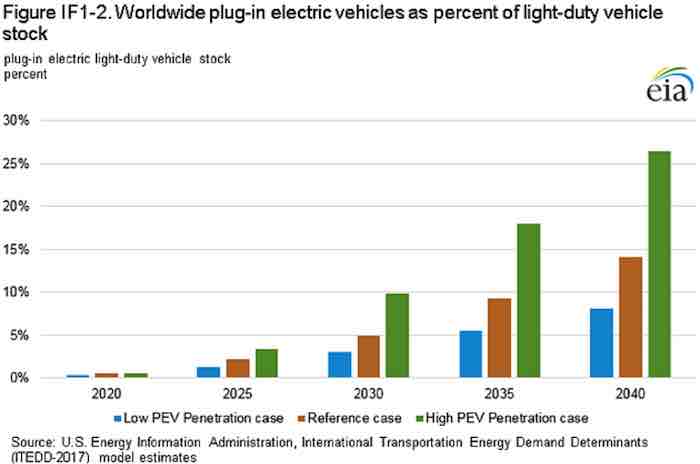

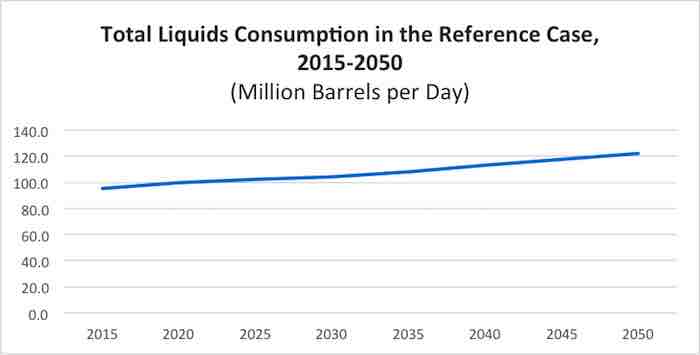

International Energy Outlook 2017 evaluated the uncertainty associated with the long-term effects that electric vehicles may have on energy markets using three scenarios of electric vehicle penetration. The cases ranged from electric vehicles accounting for 8 percent of the world’s light duty vehicle stock in the low-penetration case, to 14 percent in the reference case to 26 percent in the high-penetration case in 2040. In the reference case, EIA forecasts liquids consumption in 2040 to be 112.9 million barrels per day—almost 20 percent higher than in 2015. The reduction in liquids consumption in 2040 is 1.38 million barrels per day in the high-penetration case (1.2 percent of reference case levels) and the increase in liquids consumption in the low-penetration case is 1.0 million barrels per day or just 0.9 percent of total liquids consumption in the reference case.

Source: EIA

Source: EIA

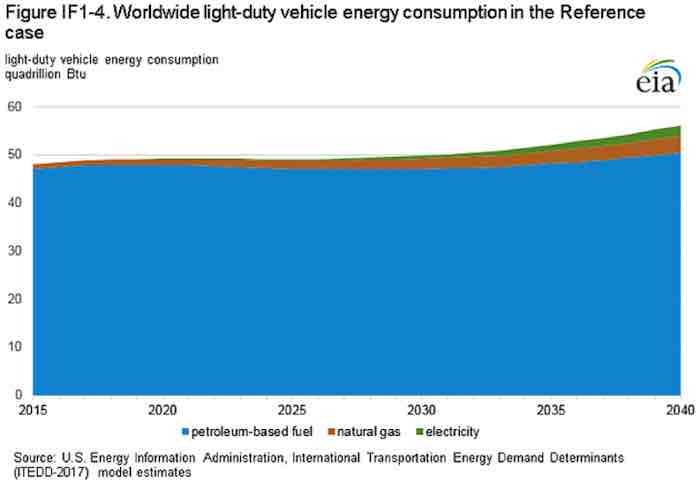

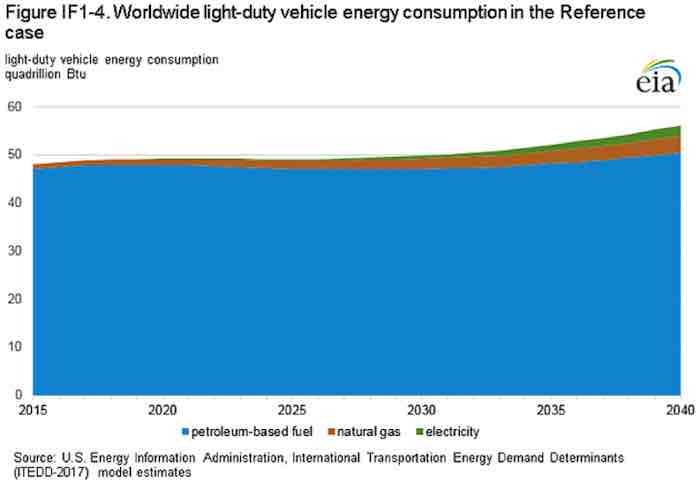

The differences in petroleum consumption in the two cases do not result in a one-to-one change in energy consumption with electricity because of the differences in efficiency between the vehicles. The battery portion of plug-in electric vehicles is more efficient than petroleum-fueled vehicles, which results in the use of fewer Btus of electricity to replace a given amount of Btus of petroleum-based fuel.

Source: EIA, IEO 2017, Table A5

Chart of liquids consumption in IEO 2017

Source: EIA, IEO 2017, Table A5

Chart of liquids consumption in IEO 2017

There are two issues affecting the results. First, the use of electric vehicles in transportation is small today. Total cumulative worldwide sales of electric vehicles in 2015 was just 1.2 million—less than 1 percent of the total number of automobiles currently in use. Second, electric vehicles are penetrating the light-duty vehicle sector because of government policies that address that sector, but there are other components of transportation with little in-roads in displacing liquid fuels.

Because of the increase in electric vehicle penetration, the share of petroleum-based fuel for light-duty vehicle use decreases from 98 percent in 2015, to 90 percent by 2040. But, liquid fuels consumption is still expected to increase by almost 20 percent between 2015 and 2040 as more petroleum-based cars are still being added to the stock and other uses of liquid fuels continue to grow.

Source: EIA

Source: EIA

New Oil Discoveries are Needed

Global conventional oil discoveries fell to a record low in 2016 as companies cut spending. In 2016, only

2.4 billion barrels of new conventional oil were discovered worldwide—much lower than the average for the last 15 years, which was 9 billion barrels. The slowdown in the conventional oil sector was the result of reduced investment spending due to low oil prices. Another year of low conventional oil discoveries are expected for 2017 due to decreased exploration spending.

In contrast to the investment slump in the conventional oil sector, the U.S. shale industry has shown great resiliency, reducing production costs by 50 percent since 2014, and increasing investment and oil production. Despite the good news in the U.S. shale oil industry, oil demand is expected to grow by 1.2 million barrels per day a year over the next five years, and the International Energy Agency warns that an extended period of sharply lower conventional oil investment could lead to a tightening in supplies. That tightening could cause oil prices to climb unless the U.S. shale oil industry can pick up the slack.

In many cases, the U.S. shale oil industry is more competitive than conventional projects. For example, the average break-even price in the Permian Basin in Texas is $40 to $45 per barrel. At current prices, liquids production from U.S. shale plays is expected to expand by 2.3 million barrels per day by 2022. If prices increase, the expansion will be greater.

The offshore sector, which accounts for almost a third of global crude oil production, has been particularly hard hit by the industry’s slowdown. For example, in the North Sea, oil investments fell to less than $25 billion in 2016, about half the level of 2014.

The Trump Redirect Comes Not a Moment Too Soon

President Trump signed legislation to open the Arctic National Wildlife Refuge and his

proposed offshore lease plan for 2019 to 2024 will open over

90 percent of the Outer Continental Shelf acreage and over 98 percent of undiscovered, technically recoverable oil and gas resources in federal offshore areas for future exploration and development. The plan proposes 47 lease sales: seven new leases in the Pacific region, 12 leases for the Gulf of Mexico, 19 for coastal Alaska and nine for the Atlantic—the largest number of lease sales in U.S. history.

Institute for Energy Research -- Bio and

Archives |

Comments

The Institute for Energy Research (IER) is a not-for-profit organization that conducts intensive research and analysis on the functions, operations, and government regulation of global energy markets. IER maintains that freely-functioning energy markets provide the most efficient and effective solutions to today’s global energy and environmental challenges and, as such, are critical to the well-being of individuals and society.

The Energy Information Administration’s (EIA) International Energy Outlook 2017 evaluated the uncertainty associated with the long-term effects that electric vehicles may have on energy markets using three scenarios of electric vehicle penetration. The cases ranged from electric vehicles accounting for 8 percent of the world’s light duty vehicle stock in the low-penetration case, to 14 percent in the reference case to 26 percent in the high-penetration case in 2040. In the reference case, EIA forecasts liquids consumption in 2040 to be 112.9 million barrels per day—almost 20 percent higher than in 2015. The reduction in liquids consumption in 2040 is 1.38 million barrels per day in the high-penetration case (1.2 percent of reference case levels) and the increase in liquids consumption in the low-penetration case is 1.0 million barrels per day or just 0.9 percent of total liquids consumption in the reference case.

The Energy Information Administration’s (EIA) International Energy Outlook 2017 evaluated the uncertainty associated with the long-term effects that electric vehicles may have on energy markets using three scenarios of electric vehicle penetration. The cases ranged from electric vehicles accounting for 8 percent of the world’s light duty vehicle stock in the low-penetration case, to 14 percent in the reference case to 26 percent in the high-penetration case in 2040. In the reference case, EIA forecasts liquids consumption in 2040 to be 112.9 million barrels per day—almost 20 percent higher than in 2015. The reduction in liquids consumption in 2040 is 1.38 million barrels per day in the high-penetration case (1.2 percent of reference case levels) and the increase in liquids consumption in the low-penetration case is 1.0 million barrels per day or just 0.9 percent of total liquids consumption in the reference case.

Source: EIA

Source: EIA Source: EIA, IEO 2017, Table A5

Chart of liquids consumption in IEO 2017

There are two issues affecting the results. First, the use of electric vehicles in transportation is small today. Total cumulative worldwide sales of electric vehicles in 2015 was just 1.2 million—less than 1 percent of the total number of automobiles currently in use. Second, electric vehicles are penetrating the light-duty vehicle sector because of government policies that address that sector, but there are other components of transportation with little in-roads in displacing liquid fuels.

Because of the increase in electric vehicle penetration, the share of petroleum-based fuel for light-duty vehicle use decreases from 98 percent in 2015, to 90 percent by 2040. But, liquid fuels consumption is still expected to increase by almost 20 percent between 2015 and 2040 as more petroleum-based cars are still being added to the stock and other uses of liquid fuels continue to grow.

Source: EIA, IEO 2017, Table A5

Chart of liquids consumption in IEO 2017

There are two issues affecting the results. First, the use of electric vehicles in transportation is small today. Total cumulative worldwide sales of electric vehicles in 2015 was just 1.2 million—less than 1 percent of the total number of automobiles currently in use. Second, electric vehicles are penetrating the light-duty vehicle sector because of government policies that address that sector, but there are other components of transportation with little in-roads in displacing liquid fuels.

Because of the increase in electric vehicle penetration, the share of petroleum-based fuel for light-duty vehicle use decreases from 98 percent in 2015, to 90 percent by 2040. But, liquid fuels consumption is still expected to increase by almost 20 percent between 2015 and 2040 as more petroleum-based cars are still being added to the stock and other uses of liquid fuels continue to grow.

Source: EIA

Source: EIA