By Fraser Institute —— Bio and Archives--March 12, 2019

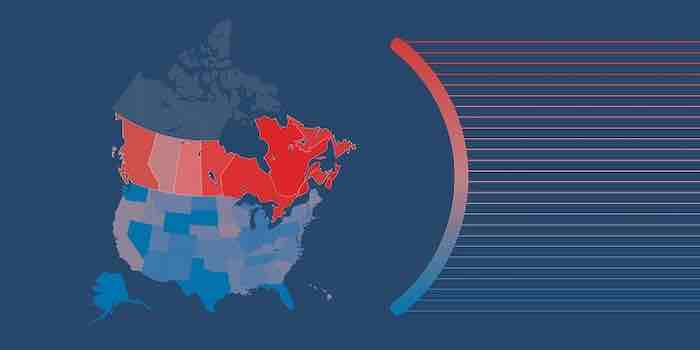

VANCOUVER—Canadian workers across the income spectrum—and across the country—pay significantly higher personal income taxes than their American counterparts, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Income taxes are a major attractant—or deterrent—for entrepreneurs, businesses and workers looking to start a business, expand operations or relocate, and at virtually every level of income, Canada’s tax rates are uncompetitive with the U.S.,” said Robert P. Murphy, Fraser Institute senior fellow and co-author of Canada’s Rising Personal Tax Rates and Falling Tax Competitiveness.

VANCOUVER—Canadian workers across the income spectrum—and across the country—pay significantly higher personal income taxes than their American counterparts, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Income taxes are a major attractant—or deterrent—for entrepreneurs, businesses and workers looking to start a business, expand operations or relocate, and at virtually every level of income, Canada’s tax rates are uncompetitive with the U.S.,” said Robert P. Murphy, Fraser Institute senior fellow and co-author of Canada’s Rising Personal Tax Rates and Falling Tax Competitiveness.The Comment section of online publications is the new front in the ongoing Cancel Culture Battle.

Big Tech and Big Media are gunning for the Conservative Voice—through their Comment Sections.

Canada Free Press wishes to stay in the fight, and we want our fans, followers, commenters there with us.

We ask only that commenters keep it civil, keep it clean.

Thank You for your patience and for staying aboard the CFP ‘Mother Ship’.

READ OUR Commenting Policy