By Institute for Energy Research ——Bio and Archives--December 17, 2014

Global Warming-Energy-Environment | CFP Comments | Reader Friendly | Subscribe | Email Us

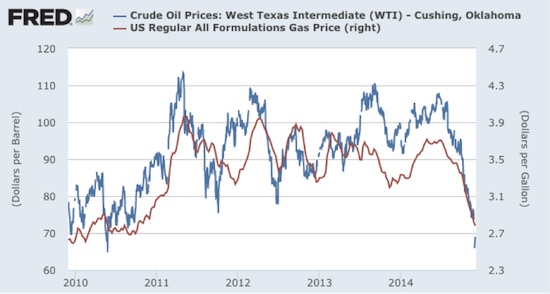

As the chart above indicates, U.S. gasoline prices (red line) have tracked the movements of crude oil (blue line) quite closely since 2010. If anything, gas prices tend not to follow crude all the way up when the blue line spikes.

As the chart above indicates, U.S. gasoline prices (red line) have tracked the movements of crude oil (blue line) quite closely since 2010. If anything, gas prices tend not to follow crude all the way up when the blue line spikes. The EIA chart shows a monthly average price of $2.61 in December 2014. Even though this is the cheapest gasoline has been since the financial crash, it’s nonetheless more expensive (in real terms) than gas has typically been since 1976. Specifically, in inflation-adjusted dollars, gasoline was cheaper during the entire period from August 1985 through March 2005 – almost a twenty-year stretch. The only reason gas seems cheap right now is that Americans have endured very high prices, (by historical standards) for the last few years.

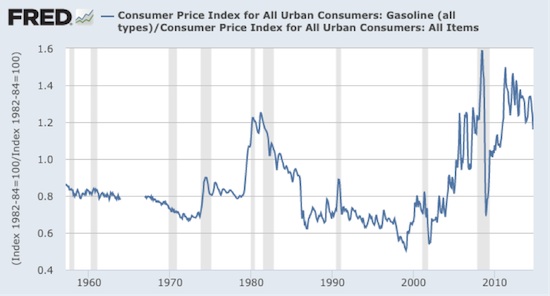

Another way of assessing current gasoline prices is to use the Consumer Price Index. The following chart plots the ratio of the gasoline component of the CPI against the CPI itself:

The EIA chart shows a monthly average price of $2.61 in December 2014. Even though this is the cheapest gasoline has been since the financial crash, it’s nonetheless more expensive (in real terms) than gas has typically been since 1976. Specifically, in inflation-adjusted dollars, gasoline was cheaper during the entire period from August 1985 through March 2005 – almost a twenty-year stretch. The only reason gas seems cheap right now is that Americans have endured very high prices, (by historical standards) for the last few years.

Another way of assessing current gasoline prices is to use the Consumer Price Index. The following chart plots the ratio of the gasoline component of the CPI against the CPI itself:

In the graph above, by construction the two indices are calibrated to 100 for the average values in the 1982-84 period, which is why their ratio (by construction) is centered at 1.0 in that time frame. As the graph makes perfectly clear, even with the recent fall, gasoline prices relative to the CPI are still much higher than they have typically been – going back to the 1950s.

In the graph above, by construction the two indices are calibrated to 100 for the average values in the 1982-84 period, which is why their ratio (by construction) is centered at 1.0 in that time frame. As the graph makes perfectly clear, even with the recent fall, gasoline prices relative to the CPI are still much higher than they have typically been – going back to the 1950s.

View Comments

The Institute for Energy Research (IER) is a not-for-profit organization that conducts intensive research and analysis on the functions, operations, and government regulation of global energy markets. IER maintains that freely-functioning energy markets provide the most efficient and effective solutions to today’s global energy and environmental challenges and, as such, are critical to the well-being of individuals and society.