By Fraser Institute ——Bio and Archives--March 19, 2024

Canadian News, Politics | CFP Comments | Reader Friendly | Subscribe | Email Us

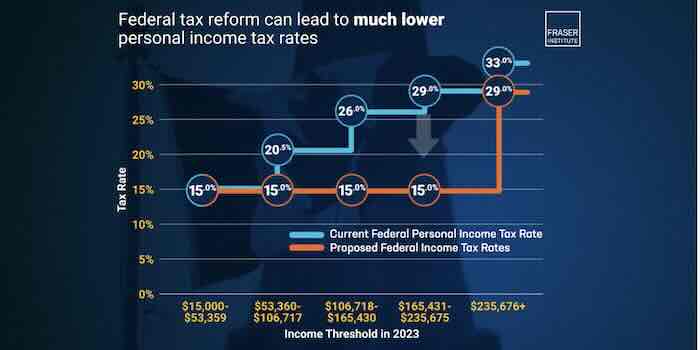

VANCOUVER—The federal government can reduce the top marginal income tax rate to 29.0 per cent—where it was before the Trudeau government increased it—and completely eliminate the three middle income tax rates of 20.5 per cent, 26.0 per cent, and 29.0 per cent by reforming and simplifying the tax code, finds a new report published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“With this plan for tax reform, the federal government could create a more pro-growth-environment than Canadians are presently living in,” said Jake Fuss, director of fiscal policy at the Fraser Institute and study co-author of Enhancing Economic Growth Through Federal Personal Income Tax Reform.

According to the analysis, there are 49 different federal tax credits, deductions, and special preferences that could be eliminated. Each of these measures currently reduces tax revenues to the federal government, the elimination of these special treatments allows the general personal income tax rates to be reduced.

In addition to eliminating a host of tax credits and deductions, a reduction of $5.6 billion in spending is also required to cover the costs of the proposed tax reforms.

These changes would establish a new tax landscape with just two federal personal income tax rates. Nearly all Canadians would face a marginal tax rate of 15.0 per cent, while top earners would pay a marginal tax rate of 29.0 per cent, the rate in place since 1988 before it was increased in 2016—providing a much-needed boost to the Canadian economy by improving the incentives to work, save, and invest and for entrepreneurship and innovation.

“By making these tax changes, Canada would be more tax competitive with the US, who currently enjoy a substantial advantage over us on personal income taxes.”

Media Contact:

Jake Fuss, Director, Fiscal Studies, Fraser Institute

To arrange media interviews or for more information, please contact:

Bryn Weese, Fraser Institute

604-688-0221 ext. 589

bryn.weese@fraserinstitute.org

View Comments

The Fraser Institute is an independent Canadian public policy research and educational organization with offices in Vancouver, Calgary, Toronto, and Montreal and ties to a global network of 86 think-tanks. Its mission is to measure, study, and communicate the impact of competitive markets and government intervention on the welfare of individuals. To protect the Institute’s independence, it does not accept grants from governments or contracts for research. Visit fraserinstitute.org.

Follow the Fraser Institute on Twitter | Like us on Facebook