Periods of exuberance with sky-high valuations of -- just about anything -- are well documented in history. One example frequently mentioned is the Tulip Mania of the 1630's in Holland, a part of The Netherlands. Even today it's still the place to get tulips and bulbs of any shape, size, color and variety known.

Fancy Tulips

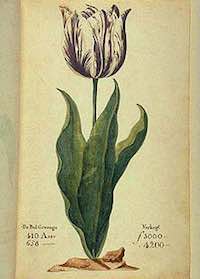

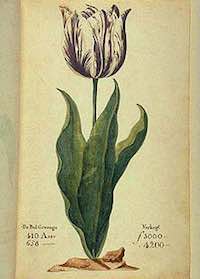

Nearly 400 years ago, fancy tulips were all the rage and especially so in Holland. Anyone who wanted to keep up with the neighbors and prove his status looked to have the latest and most fashionable variety of the plant. At the height of the bubble, bulbs of the most exotic variety, the

Viceroy, fetched the equivalent of ten times the annual income of a skilled craftsman.

The

Viceroy Tulip; source:

Wikipedia.

No doubt, the

Viceroy was a pretty tulip and, therefore, everyone "needed" it. As the supply was limited, prices skyrocketed in short order. In the four months between November 1636 and early February 1637, the valuations of rare tulip bulbs went up from an indexed value of 10 to about 200, a twenty-fold increase. Then, on February 5, 1637, the prices came crashing down - even faster and further than they had gone up; perhaps it was the end of the bulb-planting season, I'm not sure.

To this day, the country continues to grow tulips in grand style. When the plants are in bloom one could think the whole country is one giant tulip field with rows upon rows in all colors and varieties.

Other Bubbles

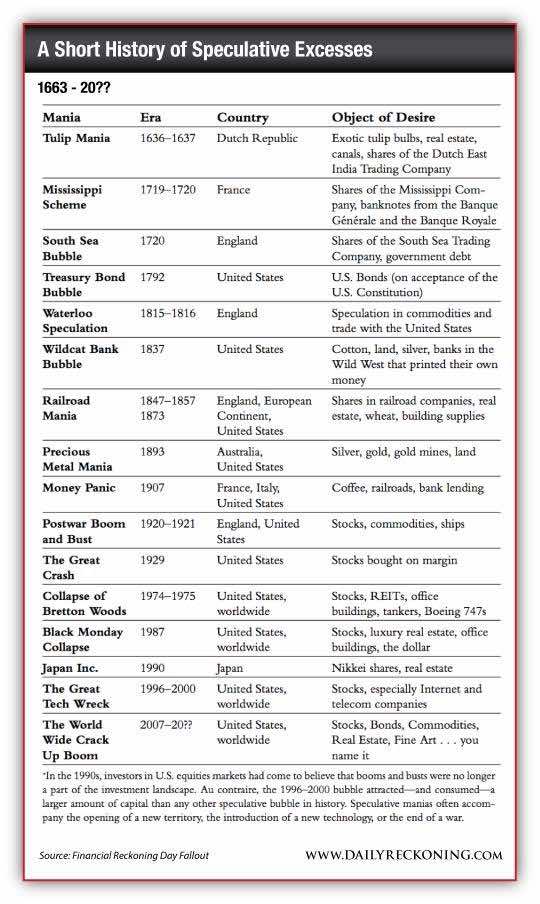

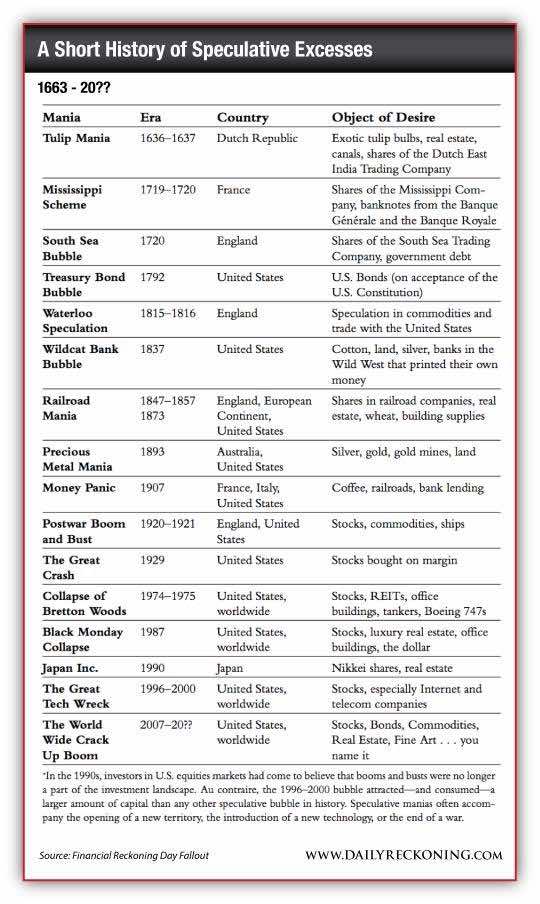

The tulip mania was, in modern financial jargon, a "bubble" par excellence. However, it was neither the first nor the last of such excesses. There were many other manias, pardon "bubbles," that followed. In fact, some you may have experienced yourself not very long ago. I just came across a table that lists a whole slew of such events, all well past the tulips' time; just look at the table below:

Perhaps you, dear reader, may remember some of these events; I certainly do. For example, at the height of the property bubble in Japan, about 25 years ago, a small parcel of land in downtown Tokyo was valued as much as all of California. Obviously, the land valuations in the Land of the Rising Sun had arrived in bubble territory then. As it so happens, sunset follows sunrise, just about each day.

Another noteworthy bubble, much closer to home was the "dot.com" bubble in North America. At the time, use of the "word wide web" (www), aka the internet had become a place to advertise, do business from and with. Any outfit with a ".com" internet address was deemed to be a money spigot at the time and forever. Well, that idea also got a rude awakening call.

In short, bubbles come and go and another one may be on its merry way right now.

It is great to ride the bubbles uphill but when they come crashing down it's a different story. Of course, in hindsight it is always all so clear and obvious; how could anyone have fallen for the scheme, the excessive valuations, the hype and so forth?

The question then must be: how do you recognize when some valuations get into "bubble territory" and when is it "time to fold?"

Time to Fold

One thing all bubbles have in common is that everyone, just about absolutely everyone in the market tells you that things are great and, THEREFORE, can only get better. The really "smart" advice you get then beckons you to be "more nimble" or "selective" or whatever the catchphrase of the day may be. That's when you ought to ask yourself the (rhetorical) question: is there anyone left to buy?

Just remember, if most people have bought what they what want (or "need") and few buyers are left to purchase more, it's time you ought to start enjoying your tulips, not planting more.

Enjoy the bloom while it lasts.

The Viceroy Tulip; source: Wikipedia.

No doubt, the Viceroy was a pretty tulip and, therefore, everyone "needed" it. As the supply was limited, prices skyrocketed in short order. In the four months between November 1636 and early February 1637, the valuations of rare tulip bulbs went up from an indexed value of 10 to about 200, a twenty-fold increase. Then, on February 5, 1637, the prices came crashing down - even faster and further than they had gone up; perhaps it was the end of the bulb-planting season, I'm not sure.

To this day, the country continues to grow tulips in grand style. When the plants are in bloom one could think the whole country is one giant tulip field with rows upon rows in all colors and varieties.

The Viceroy Tulip; source: Wikipedia.

No doubt, the Viceroy was a pretty tulip and, therefore, everyone "needed" it. As the supply was limited, prices skyrocketed in short order. In the four months between November 1636 and early February 1637, the valuations of rare tulip bulbs went up from an indexed value of 10 to about 200, a twenty-fold increase. Then, on February 5, 1637, the prices came crashing down - even faster and further than they had gone up; perhaps it was the end of the bulb-planting season, I'm not sure.

To this day, the country continues to grow tulips in grand style. When the plants are in bloom one could think the whole country is one giant tulip field with rows upon rows in all colors and varieties.