Replacing Canada’s coal-fired power plants with wind and solar would cost between $16.8 and $33.7 billion annually

VANCOUVER—Replacing coal-fired power in Canada with renewable energy will impose significant costs on Canada’s economy while only making modest reductions in greenhouse gas emissions, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Despite what advocates claim, renewable power—including wind and solar—isn’t free and comes with only modest benefits to the environment,” said G. Cornelis van Kooten, economics professor at the University of Victoria, senior fellow at the Fraser Institute and author of Canadian Climate Policy and its Implications for Electricity Grids.

VANCOUVER—Replacing coal-fired power in Canada with renewable energy will impose significant costs on Canada’s economy while only making modest reductions in greenhouse gas emissions, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Despite what advocates claim, renewable power—including wind and solar—isn’t free and comes with only modest benefits to the environment,” said G. Cornelis van Kooten, economics professor at the University of Victoria, senior fellow at the Fraser Institute and author of Canadian Climate Policy and its Implications for Electricity Grids.

- Thursday, October 21, 2021

VANCOUVER—Fundamental reform of Canada’s health care system needs to start with replicating changes made in the 1990s when Ottawa removed strings to federal funding for welfare to provide the provinces with more autonomy and flexibility, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“COVID-19 has exacerbated two of the most important ongoing public policy challenges facing Canada: the deterioration of government finances, and the comparative underperformance of our health care system,” said Ben Eisen, senior fellow at the Fraser Institute and co-author of

VANCOUVER—Fundamental reform of Canada’s health care system needs to start with replicating changes made in the 1990s when Ottawa removed strings to federal funding for welfare to provide the provinces with more autonomy and flexibility, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“COVID-19 has exacerbated two of the most important ongoing public policy challenges facing Canada: the deterioration of government finances, and the comparative underperformance of our health care system,” said Ben Eisen, senior fellow at the Fraser Institute and co-author of  VANCOUVER—Due in part to Canada’s unfavourable business environment—which includes higher taxes, more regulation and lack of pipeline capacity—oil and gas investors will likely continue to divert investments from Canada to the United States, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Financial capital is mobile, so policymakers in Canada must understand that government policies have helped facilitate the flight of oil and gas investment from Canada to the U.S.,” said Steven Globerman, professor emeritus at Western Washington University, resident scholar at the Fraser Institute and co-author of

VANCOUVER—Due in part to Canada’s unfavourable business environment—which includes higher taxes, more regulation and lack of pipeline capacity—oil and gas investors will likely continue to divert investments from Canada to the United States, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

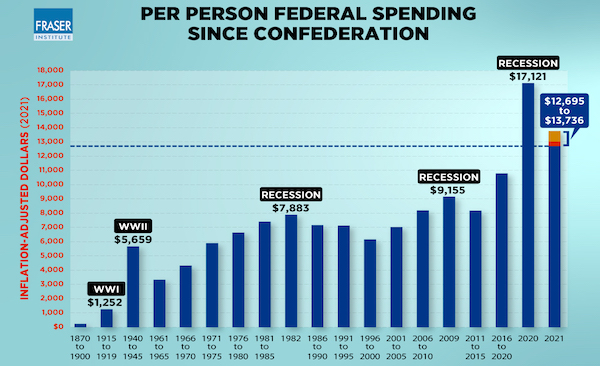

“Financial capital is mobile, so policymakers in Canada must understand that government policies have helped facilitate the flight of oil and gas investment from Canada to the U.S.,” said Steven Globerman, professor emeritus at Western Washington University, resident scholar at the Fraser Institute and co-author of  VANCOUVER— Per-person federal program spending is expected to reach a minimum of $13,032 in 2021/22 (adjusted for inflation), which is 34.8 per cent higher than in 2019, pre-COVID, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

VANCOUVER— Per-person federal program spending is expected to reach a minimum of $13,032 in 2021/22 (adjusted for inflation), which is 34.8 per cent higher than in 2019, pre-COVID, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

VANCOUVER—Despite spending an additional $5.6 billion in 2019-20, the new Canada Child Benefit only moved an estimated 90,900 children above Statistics Canada’s Low-Income Cut-Off, a key measure of low-income, finds a new essay released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“One of the stated goals of the Canada Child Benefit was to help lift children out of poverty, but most of the households that benefit from this new program compared to the previous ones were never living in poverty in the first place,” said Professor Christopher Sarlo, senior fellow at the Fraser Institute and author of

VANCOUVER—Despite spending an additional $5.6 billion in 2019-20, the new Canada Child Benefit only moved an estimated 90,900 children above Statistics Canada’s Low-Income Cut-Off, a key measure of low-income, finds a new essay released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“One of the stated goals of the Canada Child Benefit was to help lift children out of poverty, but most of the households that benefit from this new program compared to the previous ones were never living in poverty in the first place,” said Professor Christopher Sarlo, senior fellow at the Fraser Institute and author of  MONTRÉAL—As Canadians and policymakers consider changes to long-term care, it’s important to recognize and learn lessons from more successful long-term care systems in other countries with universal health care, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“The difficulties in meeting the care needs of the elderly in nursing homes or at home in Canada long precede the arrival of the COVID-19 pandemic,” explained Yanick Labrie, senior fellow at the Fraser Institute and author of

MONTRÉAL—As Canadians and policymakers consider changes to long-term care, it’s important to recognize and learn lessons from more successful long-term care systems in other countries with universal health care, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“The difficulties in meeting the care needs of the elderly in nursing homes or at home in Canada long precede the arrival of the COVID-19 pandemic,” explained Yanick Labrie, senior fellow at the Fraser Institute and author of  TORONTO—Economic growth and business investment in Canada have been faltering, which has severely weakened the country’s ability to encourage innovation or new business start-ups, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Canada’s sluggish economic growth in the years before the pandemic reflects a lack of innovation and weak productivity growth,” said Philip Cross, senior fellow at the Fraser Institute and author of Canada’s Faltering Business Dynamism and Lagging Innovation.

TORONTO—Economic growth and business investment in Canada have been faltering, which has severely weakened the country’s ability to encourage innovation or new business start-ups, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Canada’s sluggish economic growth in the years before the pandemic reflects a lack of innovation and weak productivity growth,” said Philip Cross, senior fellow at the Fraser Institute and author of Canada’s Faltering Business Dynamism and Lagging Innovation.

TORONTO—Ontario has experienced weak business investment over the past two decades with one of the lowest growth rates in the country, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“The decline of Ontario’s manufacturing sector in the 2000s, the 2008/09 recession, and a tepid recovery have combined to create an extended period of economic weakness for the province,” said Ben Eisen, senior fellow at the Fraser Institute and co-author of

TORONTO—Ontario has experienced weak business investment over the past two decades with one of the lowest growth rates in the country, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“The decline of Ontario’s manufacturing sector in the 2000s, the 2008/09 recession, and a tepid recovery have combined to create an extended period of economic weakness for the province,” said Ben Eisen, senior fellow at the Fraser Institute and co-author of  VANCOUVER—A typical Canadian family of four will pay an estimated $15,039 for public health-care insurance this year, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Canadians pay a substantial amount of money for health care through a variety of taxes—even if we don’t pay directly for medical services,” said Bacchus Barua, associate director of health policy studies at the Fraser Institute and co-author of

VANCOUVER—A typical Canadian family of four will pay an estimated $15,039 for public health-care insurance this year, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Canadians pay a substantial amount of money for health care through a variety of taxes—even if we don’t pay directly for medical services,” said Bacchus Barua, associate director of health policy studies at the Fraser Institute and co-author of  TORONTO—In the Fraser Institute’s annual

TORONTO—In the Fraser Institute’s annual  TORONTO—Building codes in Canada contribute to homelessness by reducing the supply of low-income housing, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“When addressing homelessness, well-intentioned policymakers often overlook the significant issue of building codes and how they can actually make the lives of low-income people much worse,” said John Palmer, Professor Emeritus from the University of Western Ontario and co-author of

TORONTO—Building codes in Canada contribute to homelessness by reducing the supply of low-income housing, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“When addressing homelessness, well-intentioned policymakers often overlook the significant issue of building codes and how they can actually make the lives of low-income people much worse,” said John Palmer, Professor Emeritus from the University of Western Ontario and co-author of  CALGARY—The debt the federal government is expected to accumulate now, and in the future, will be disproportionately paid for by younger Canadians, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

CALGARY—The debt the federal government is expected to accumulate now, and in the future, will be disproportionately paid for by younger Canadians, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

VANCOUVER—This Labour Day, workers and employers should push for improved productivity, the key to a four-day workweek and more work-from-home opportunities, suggests an article released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“The pandemic has encouraged workplace innovations that can continue into the future if workers become more productive,” said Steven Globerman, resident scholar at the Fraser Institute and author of Four-Day Work Week and Work-From-Home Initiatives Hinge on Improving Productivity.

VANCOUVER—This Labour Day, workers and employers should push for improved productivity, the key to a four-day workweek and more work-from-home opportunities, suggests an article released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“The pandemic has encouraged workplace innovations that can continue into the future if workers become more productive,” said Steven Globerman, resident scholar at the Fraser Institute and author of Four-Day Work Week and Work-From-Home Initiatives Hinge on Improving Productivity.

TORONTO—The costs of government regulation, including labour regulations such as licencing and accreditation, represent a real barrier for Canadians—especially low-income Canadians—trying to move up the income ladder, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Government regulations impede the ability of Canadians to make themselves better off by slowing the upward mobility of workers,” said Vincent Geloso, an assistant professor of economics at George Mason University, senior fellow at the Fraser Institute and co-author of

TORONTO—The costs of government regulation, including labour regulations such as licencing and accreditation, represent a real barrier for Canadians—especially low-income Canadians—trying to move up the income ladder, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Government regulations impede the ability of Canadians to make themselves better off by slowing the upward mobility of workers,” said Vincent Geloso, an assistant professor of economics at George Mason University, senior fellow at the Fraser Institute and co-author of  CALGARY—Despite the COVID-19 pandemic and shutdowns driving down tax revenues collected by governments across Canada, the average Canadian family still spent over 36 per cent of its income on taxes in 2020—more than housing, food and clothing costs combined, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Throughout the COVID pandemic, as tax revenues decreased for governments nationwide, taxes remained the largest household expense for Canadian families,” said Jake Fuss, economist at the Fraser Institute and co-author of

CALGARY—Despite the COVID-19 pandemic and shutdowns driving down tax revenues collected by governments across Canada, the average Canadian family still spent over 36 per cent of its income on taxes in 2020—more than housing, food and clothing costs combined, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Throughout the COVID pandemic, as tax revenues decreased for governments nationwide, taxes remained the largest household expense for Canadian families,” said Jake Fuss, economist at the Fraser Institute and co-author of  TORONTO—Despite common misperceptions, education spending in public schools in Ontario has increased substantially over the most recent five-year period of available data, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Contrary to the popular narrative that education spending in public schools has been cut in Ontario, it’s actually increased and exceeds what was required to account for enrolment changes and inflation in the province,” said Paige MacPherson, associate director of education policy at the Fraser Institute and co-author of

TORONTO—Despite common misperceptions, education spending in public schools in Ontario has increased substantially over the most recent five-year period of available data, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Contrary to the popular narrative that education spending in public schools has been cut in Ontario, it’s actually increased and exceeds what was required to account for enrolment changes and inflation in the province,” said Paige MacPherson, associate director of education policy at the Fraser Institute and co-author of  VANCOUVER—From 2015 to 2019, before the COVID-19 pandemic and recession struck, Canada’s growth rate of business investment was lower than virtually any other period since 1970, according to a new study by the Fraser Institute, an independent non-partisan Canadian think tank.

VANCOUVER—From 2015 to 2019, before the COVID-19 pandemic and recession struck, Canada’s growth rate of business investment was lower than virtually any other period since 1970, according to a new study by the Fraser Institute, an independent non-partisan Canadian think tank.

CALGARY—The top 20 per cent of income-earning families pay more than half (54.7 per cent) of total taxes including personal income, sales and property taxes, according to a new study published by the Fraser Institute, an independent non-partisan Canadian think tank.

“Despite the common misperception that top earners don’t pay their ‘fair share’ of taxes, in reality these households pay a disproportionately large share of the total tax bill,” said Tegan Hill, economist at the Fraser Institute and co-author of Measuring Progressivity in Canada’s Tax System.

CALGARY—The top 20 per cent of income-earning families pay more than half (54.7 per cent) of total taxes including personal income, sales and property taxes, according to a new study published by the Fraser Institute, an independent non-partisan Canadian think tank.

“Despite the common misperception that top earners don’t pay their ‘fair share’ of taxes, in reality these households pay a disproportionately large share of the total tax bill,” said Tegan Hill, economist at the Fraser Institute and co-author of Measuring Progressivity in Canada’s Tax System.

TORONTO—Countries around the world are pursuing climate policies that will do more harm through economic and social costs than good, according to a new analysis by the Fraser Institute, an independent non-partisan Canadian think tank.

TORONTO—Countries around the world are pursuing climate policies that will do more harm through economic and social costs than good, according to a new analysis by the Fraser Institute, an independent non-partisan Canadian think tank.