By Matthew Vadum -- BombThrowers—— Bio and Archives--November 6, 2017

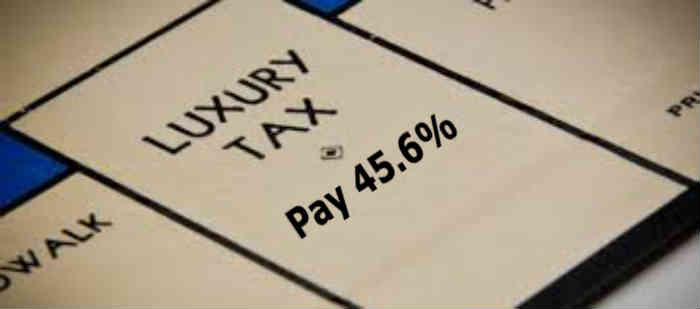

The GOP’s newly unveiled tax reform legislation would raise taxes on high earners to 45.6 percent, not cap them at 39.6 percent, as its proponents claim, according to an analysis of the proposal by Danny Vinik of Politico.

Republicans’ proposed “Tax Cuts and Jobs Act” would collapse the current seven individual income tax brackets – 10, 15, 25, 28, 33, 35, and 39.6 percent into just four – 12, 25, 35, and 39.6 percent – according to a summary of major details by the Tax Foundation.

The GOP’s newly unveiled tax reform legislation would raise taxes on high earners to 45.6 percent, not cap them at 39.6 percent, as its proponents claim, according to an analysis of the proposal by Danny Vinik of Politico.

Republicans’ proposed “Tax Cuts and Jobs Act” would collapse the current seven individual income tax brackets – 10, 15, 25, 28, 33, 35, and 39.6 percent into just four – 12, 25, 35, and 39.6 percent – according to a summary of major details by the Tax Foundation.The Comment section of online publications is the new front in the ongoing Cancel Culture Battle.

Big Tech and Big Media are gunning for the Conservative Voice—through their Comment Sections.

Canada Free Press wishes to stay in the fight, and we want our fans, followers, commenters there with us.

We ask only that commenters keep it civil, keep it clean.

Thank You for your patience and for staying aboard the CFP ‘Mother Ship’.

READ OUR Commenting Policy